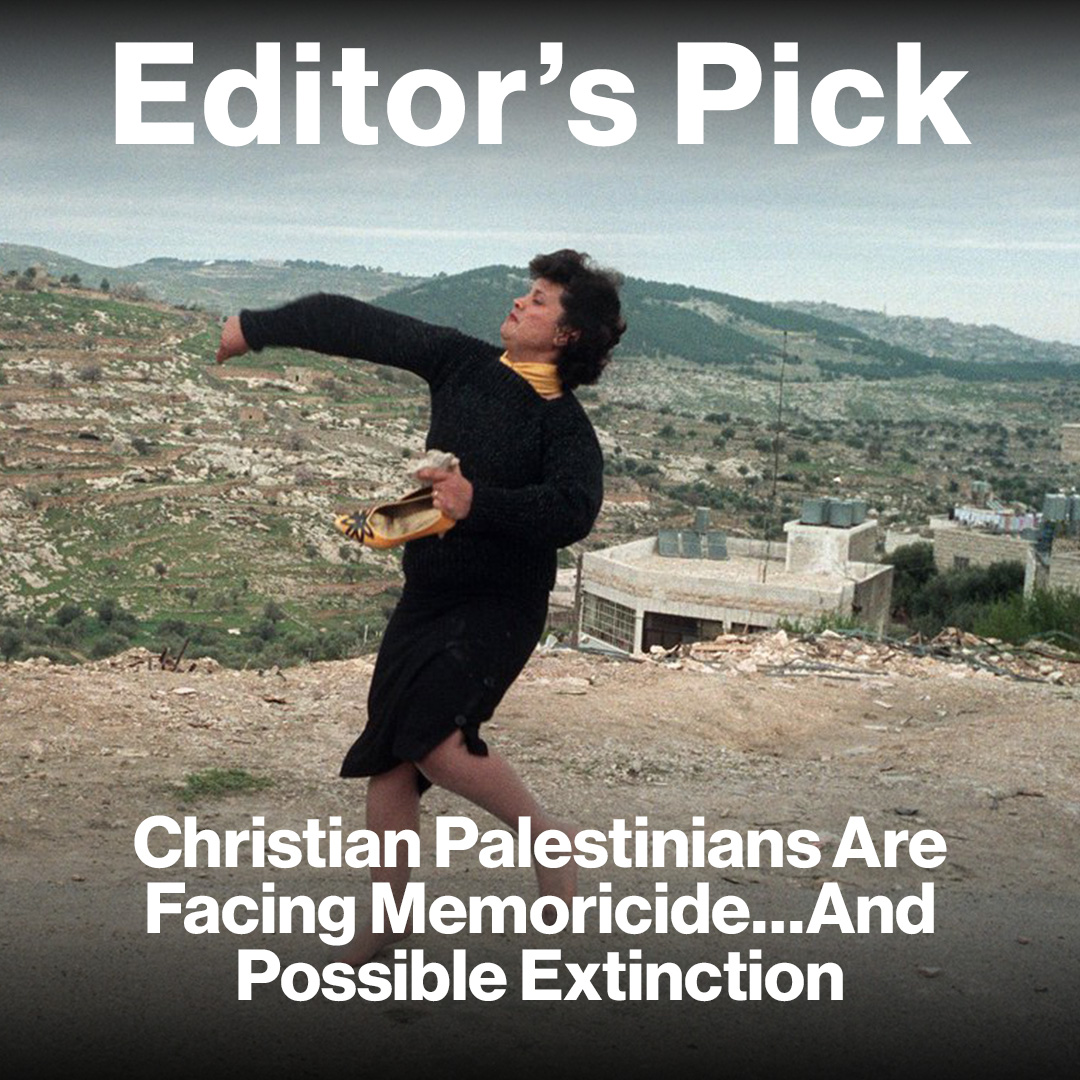

How to Choose the Right Accelerator Program for Your Business

Staff writer May El Habachi reached out to experienced entrepreneurs in the accelerator space to discuss the intricacies of choosing the program that fits your startup best.

It appears that the MENA region has not just bounced back from the downturn of the COVID-19 pandemic, but has flourished as well. Total funding secured by startups in the MENA region more than doubled to $864 million in Q1 2022, according to data platform Magnitt, indicating an outpour of confidence from investors in the region’s economic resilience.

This surge in growth has led to accelerators playing an important role in positioning entrepreneurs for success. From helping them build successful products to identifying promising customer segments and securing much-needed capital, accelerators have been quick to offer support to new and established startups alike. But with the growing number of accelerators in the region, it may be difficult for startups to choose the right program for their business.

MAKE SURE IT IS THE RIGHT FIT

Before choosing an accelerator program, entrepreneurs should have an idea of what they need to focus on to grow their startups. “All of these things - funding, mentorship, networking - are quite different,” says Yehia Houry, Chief Program Officer at Flat6Labs. “And some accelerators focus on one or two of those things, and some focus on all of them.”

Founders should also be clear on the stage of their startup, as some accelerators are dedicated to early-stage startups, while others are focused on growth-stage startups. The latter program tends to have specific traction expectations before joining and when exiting from the program, making it unsuitable for newly established entities.

“Everyone wants to go to the high growth accelerator,” Houry says. “But in reality, it may be a detriment to the startup if they join a program that really focuses on sales or aims to get closer to corporations when the product is not finished yet. We see that sometimes when we are really pushing on the business side, but the reality is that they’re not yet advanced on the product side, so they miss out on a lot of opportunities as opposed to someone who is ready to sell.”

DECIDE BETWEEN INDUSTRY-SPECIFIC OR GENERAL ACCELERATOR PROGRAM

Industry fit matters. Some accelerators are good for almost any type of business, while others are very specialized in certain industries or verticals, and are therefore a good fit for those businesses.

“We work with all types of startups, because we are sector agnostic,” says Nihal El Chami, Head of Program and Marketing at Falak Startups. “We have experience in different industries, as we’ve worked with over 80 startups so far. However, if a startup is very industry specific, like fintech, they can join a program that focuses solely on fintech.” Falak Startups’ sister company, EFG EV, is an example of one such fintech program.

DON’T JOIN JUST FOR THE INVESTMENT

Scaling and growing your company will require money. Typically, accelerators invest in startups in return for some equity, so if founders aren’t interested in the accelerator’s program, they should consider other ways of raising funds, whether by bootstrapping or seeking out angel investors.

“Accelerators usually have a standard model, and treat all startups the same way,” explains Chami. “For example, if we put LE 1 million, we take 10% equity. Accelerators tend to take more percentage because they give a lot of support in return.”

Sometimes, however, startups simply don’t have the time to commit to a program. In this situation, Houry suggests that founders divide their time and attend the most relevant training sessions for their business. “There are certain sessions, for example, where the head of marketing or product could actually join and get the training if the CEO is busy trying to grow the company,” he says. “It’s a win-win. The money will actually make an impact for the startup, and so will the support.”

NETWORK MATTERS

Many startups join accelerators for their network. Not only for the network of investors, but for the network of mentors and business partners. Alaa Afifi - CEO and founder of Bekia, an Egypt-based waste management startup - joined an accelerator program in 2019 to help grow and scale his business.

“Before looking at money, look at the network of an accelerator. Network is money too,” he says. “All programs provide about the same amount of funding, but the network is what’s truly valuable. Network of investors, network of companies, and network of businesses are all valuable for startups.”

Chami takes this a step further and adds that the network of entrepreneurs is also equally important. “An entrepreneur’s journey is hard,” she says. “It’s important that they don’t feel alone. When they gather at the office, even if it’s a casual meet up, they enjoy it because they feel they can share their struggles and people can understand them.”

CHECK OUT THE PROGRAM CURRICULUM

It goes without saying that startups should look into an accelerator’s curriculum before deciding on a program. While the theoretical aspect of most accelerator curricula are similar, what matters most is the way an accelerator implements it. The more experience mentors have, the better the learning will be.

Chami from Falak Startups provides tailored programs for founders to help them address their particular pain points. Instead of offering basic training, she sits with entrepreneurs to learn exactly what they need help with, and tries to provide it through workshops, training and mentorships. “We cannot provide something to all people while they are at different stages,” she says. “Now, we sit with startups, pinpoint an issue and bring experts to sit with them and follow up, so that they can really benefit from the training. Startups now find these tailored programs very useful.”

There is no doubt that accelerators can be great partners for startups. It is worth taking the time, however, to carefully evaluate the type of accelerators available to choose the one that is right for your business.

- Previous Article Dr.Sisilove or How (Not) To Diffuse A Bomb

- Next Article Select 156: Mixed by YO-LAN-DA B2B Noubi

Trending This Week

-

Apr 10, 2024

-

Apr 10, 2024